How centralized banking system looks? Let’s understand this complex traditional banking system by breaking it down layer-by-layer.

Layer 1. Say Bob wants to pay Sasha 10$. Both hold an account with the same bank ‘Deutsche bank’.

Since no money is leaving or entering the bank, they just have to update their accounting system to balance out. So here is how the process will look:

– Bob tells the bank to credit Sasha’s account with 10$.

– Deutsche bank then debits the funds from Bob’s account and credit 10$ to Sasha’s account.It is done with the Deutsche bank core banking system and They owe now Sasha 10$ more and Bob, 10$ less.

Layer 2. But what if Sasha has a bank account with a different bank, say HSBC. What happens then?

It’s easy for Deutsche Bank to reduce or increase balance in their own system but how to deal with HSBC. If we want HSBC to owe Sasha’s more, they need to owe somebody a little less. So how to persuade HSBC to increase Sasha’s balance by 10$?

The answer to this situation is if Deutsche bank held an account with HSBC and HSBC does the same. Both hold balances with each other and adjust them to make it work out in their respective banking system.

So this is how our challenge in Layer 2 will be solved,

– Deutsche bank reduces 10$ from Bob’s account and adds it to the HSBC account held at their bank.

– Instructs HSBC about the transaction (via SWIFT) that they have increased HSBC balance by 10$ and in turn would like Sasha’s account held at HSBC to be increased by 10$.

– HSBC acknowledging the message debits from Deutsche bank account’s balance and credits Sasha’s with 10$.Layer 3. The above arrangement works well, but it has problems – Cost and Liquidity.

SWIFT is not cheap: If Deutsche Bank had to send a SWIFT message to HSBC every time Bob pays 10$ to Sasha or other HSBC customers, Bob may face hefty charges for settlement.

Liquidity issue: Think about how much money Deutsche bank would need to have tied up at all its correspondent banks every day. They would need to maintain sizeable balances at all the other banks just in case their customers wanted to send money to a recipient at HSBC or SBI or CITI or wherever. This cash could be invested or lent or otherwise put to other use.

Solution: In theory, all customer transaction from Deutsche bank to HSBC and Vice Versa balances out to very less amount. So what if we kept track of all the payments during the day and only settled the balance?

By adopting this approach, each bank could hold a whole lot less cash at all its corresponding banks. Such an arrangement could cut down the cost and liquidity demands and banks could put their money to work more effectively.

This thinking gave birth to ‘Net settlement systems’. In such an arrangement,

– Messages (or files) are sent to a central “clearing” system, which keeps track of all the payments.

– On the fixed schedule, “clearing system” calculates the net amount owed by each bank to each other.

– Banks then settle amongst themselves by transferring money to/from the accounts they hold with each other.Layer 4. But this approach also introduces a problem – Delay.

Banks might issue payment instruction in the morning but the receiving bank doesn’t receive the funds until later. The receiving bank, therefore, has to wait until they receive the net settlement, just in case the sending bank goes bust in the interim. This introduces a delay.

To solve this, We need a system like the first one (Bob pays Sasha at the same bank) because it’s really quick. So, If the banks could all hold accounts with a bank that cannot go bust, a bank that sat in the middle of the system ‘central bank’. This thought process motivated the idea of Real-Time Gross Settlement system.

If all banks in a country hold accounts with the central bank, then they can move money between themselves simply by instructing the central bank to debit one account and credit the other. They allow real-time movements of funds between accounts held by banks at their respective central bank.

This final leg works out well but also has limitations.

Remember, settlement in “real-time” means a payment transaction is not subjected to any waiting period. This coordination drives up the cost.

Therefore, settlement in real-time is subject to certain conditions such as payments have to be above a certain threshold. Moreover, all the above-mentioned arrangements are subject to clearing on a certain working hour or day.

Can blockchain replace central banks system

Transferring money in the above traditional systems is time-consuming and requires intermediaries, each of which takes a service charge. Blockchain reduces middlemen while increasing security. Use of blockchain can improve transaction time and save billions.

Many banks have started creating their own blockchain and digital currency such as JP Morgan and Mizuho Financial Group of Japan. At this stage, banks are building a layer 1 solution (remember – Bob wants to pay Sasha 10$. Both hold an account with the same bank) for their customers.

— Citește pe cryptopurview.com/how-centralized-banking-system-manage-our-fund-transaction/

Category: Education

BBC, tech giants will fight fake news with an ‘early warning system’

Tech companies know disinformation remains a major threat, and they’re forming an alliance with a media giant to help fight the online spread of falsehoods. The BBC has partnered with Facebook, Google and Twitter on a strategy to fight fake news and other disinformation campaigns. The effort will include an “early warning system” that lets organizations tell each other when they find false content that “threatens human life or disrupts democracy.” Ideally, this helps companies quickly neuter disinformation before it has much of a chance to spread.

The plan also involves a joint media education campaign, shared learning (with a focus on elections) and voting information. More details are coming “at a later date,” the BBC said.

The timing of the collaboration likely isn’t a coincidence. Internet giants know that the 2020 US presidential election is fast approaching, and they’re already working with intelligence agencies to tackle disinformation and security risks. The companies don’t want any risk of repeating the missteps from 2016, and that means forging pacts with anyone that can further their goals. While the BBC clearly isn’t based in the US, its work could be useful for fighting election meddling in the country on top of any help it can offer abroad.

Crypto News: about Goldman Sachs, Blockchain Capital, Shell, LG Electronics & more

- Goldman Sachs officially launched a cryptocurrency unit and announced a new job of a cryptocurrency project manager. In the message of the organization it is noted that this time the bank is ready to “move further than ever” in the field of digital assets.

- Anchorage, a crypto-custodian company serving institutional investors, completed a round of fundraising for Series B, raising $40 million. According to the company, this round was led by Blockchain Capital. Visa also took part.

- One of the five largest oil and gas companies in the world, Shell has invested an unnamed amount in the US energy blockchain start-up LO3.

- It is assumed that the South Korean corporation LG Electronics is developing its own cryptocurrency wallet. At the moment, the company is trying to register the appropriate patent. This is evidenced by the application on the website of the United States Patent and Trademark Office.

- Now users of Poloniex from the United States will be able to deposit and withdraw funds using bank accounts, as well as pay tokens with debit and credit cards.

LIBRA Analysis or Facebook entry in Exchange Traded Fund business with massive potential consumer base

Overview

The structure of Libra is analogous to the popular Exchange Traded Fund (ETF) model, where unit holders are entitled to the financial returns of a basket of financial assets. The units are tradable on exchanges and a select group of authorised participants are able to create and redeem units using the underlying assets.

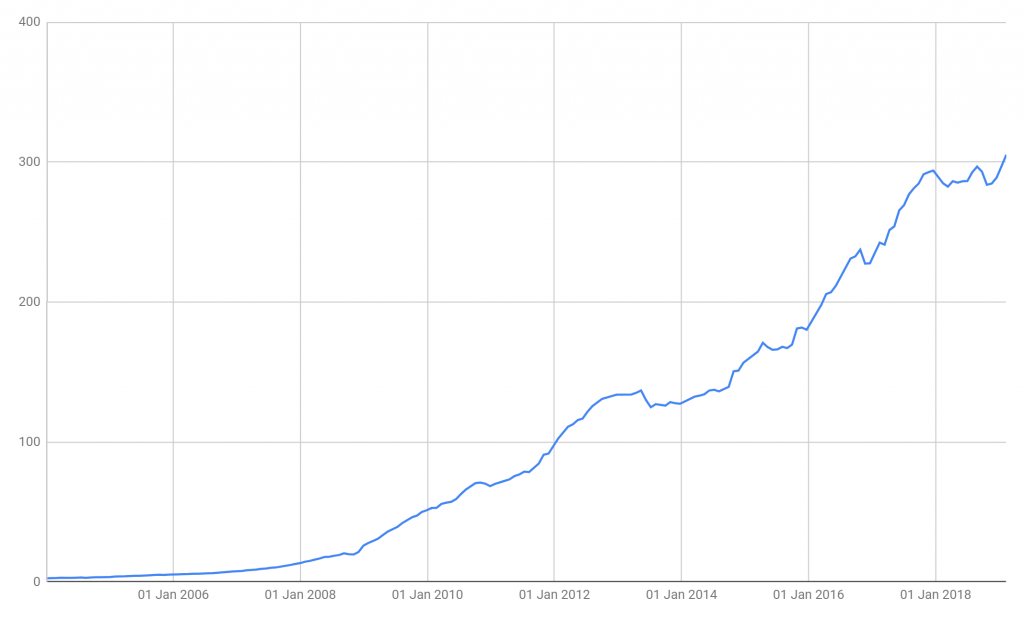

As we pointed out in our February 2019 piece, the ETF industry has enjoyed considerable growth in the last decade or so, in particular in the area of fixed income (See figure 1 below). In June 2019, in a bombshell moment for the ETF industry and challenge for the established players such as Blackrock and Vanguard, social media and internet conglomerate Facebook, entered the game. In a direct challenge to Blackrocks’s “iShares Core U.S. Aggregate Bond ETF” (AGG), Facebook announced plans to launch a new ETF, the “Libra ETF”, also focused on fixed income and government bonds.

Figure 1 – Size of the Top Bond ETFs Targeting US Investors – US$ Billion

(Source: BitMEX Research, Bloomberg)

(Note: The chart represents the sum of the market capitalisations of the following bond ETFs: iShares Core U.S. Aggregate Bond ETF, Vanguard Total Bond Market ETF, iShares iBoxx $ Investment Grade Corporate Bond ETF, Vanguard Short-Term Corporate Bond ETF, Vanguard Short-Term Bond ETF, Vanguard Intermediate-Term Corporate Bond ETF, iShares J.P. Morgan USD Emerging Markets Bond ETF, Vanguard Total International Bond ETF, iShares MBS Bond ETF, iShares iBoxx $ High Yield Corporate Bond ETF, PIMCO Enhanced Short Maturity Strategy Fund, Vanguard Intermediate-Term Bond ETF, iShares Short-Term Corporate Bond ETF, SPDR Barclays High Yield Bond ETF, iShares Short Maturity Bond ETF)

Comparing the new ETF structure with the traditional space

In figure 2 below, we have analysed and compared the new innovative Libra ETF to a traditional ETF, Blackrock’s iShares Core US Aggregate Bond ETF (AGG). Our analysis shows that, although the Libra product is new, much of the relevant information, such as transparency of the holdings and frequency of the publication of the NAV, has not yet been disclosed.

The analysis also highlights that Libra may suffer from unnecessary complexity with respect to portfolio management. The fund appears to be managed by the Libra Association, which consists of many entities in multiple industries across the globe. These same entities are responsible for issuing the ETF and the list of companies is set to expand further. At the same time, the investment mandate is unclear. In contrast Blackrock’s fixed income ETF product has a clear investment mandate, to track the Bloomberg Barclays U.S. Aggregate Bond Index, which is managed independently of the ETF issuer.

Perhaps the most significant disadvantage of the Libra product, is that unit holders do not appear to be entitled to receive the investment income. This contrasts unfavourably with Blackrock’s product, which focuses on an almost identical asset class and has an investment yield of around 2.6%. Defenders of Libra could point out that the expenses need to be covered from somewhere and that the Libra’s expense fee is not yet disclosed. However, the ETF industry is already highly competitive, with Blackrock charging an expense fee of just 0.05%. This expense fee is far lower than the expected investment yield of the product, at around 2.6% and therefore the Libra ETF may not be price competitive, a key potential disadvantage for potential investors.

Cambridge Study: Lack Of Standard Terms for Crypto Hampers Global Regulatory Response

The lack of standard global terminology for crypto assets is a major impediment for the adoption of clear regulatory policies in the industry, according to a study by the Cambridge Centre for Alternative Finance (CCAF) released on April 16.

According to the report, a variety of major terms in the crypto industry is often used interchangeably and without a clear definition, which hampers global regulatory response.

Conducted with support from the Nomura Research Institute (NRI), the research provides a detailed analysis of the regulatory landscape on crypto asset activities in 23 jurisdictions. The research data was collected mainly through desktop research from November 2018 to early February 2019, the report notes.

According to the study, the term “cryptoasset” itself lacks a specific definition and is widely used as an umbrella term to refer to digital tokens that are issued and transferred on distributed ledger technology (DLT), specifically blockchain, systems. The research argues that the terms crypto asset and token have different meanings depending on the context.

As such, the report provides three major contexts for the definition of crypto assets. In a broad sense, the term encompasses all types of digital tokens issued and distributed on a blockchain. From an intermediate perspective, a crypto asset includes all types of digital tokens on a blockchain with open access, which do not necessarily need to perform a function. In a narrow view, crypto assets exclusively refer to digital tokens on open DLT systems that play an essential role in functioning, the report reads.

The researchers further outlined three major challenges that are faced by global regulators of crypto. Prior to the adoption of clearly defined, standardized terminology, regulatory jurisdictions should first understand the nuances of the different terms and identify the terminology that is most suitable to their regulatory objectives.

In addition, the CCAF research says that the 82% of analyzed jurisdictions have distinguished crypto assets that have characteristics of a security from other types of cryptos. Based on that, activities relating to crypto assets that are considered securities are automatically brought under the authority of local securities laws, the report says.

Singapore Central Bank Publishes Updated ICO Guidelines

The Monetary Authority of Singapore (MAS) has updated its guide for businesses that want to raise capital via initial coin offerings (ICO).

— Citește pe www.ccn.com/singapore-central-bank-publishes-updated-ico-guidelines/

IMF Chief Lagarde: Central Banks Should ‘Consider’ Issuing Digital Currency

The Managing Director and Chairperson of the International Monetary Fund (IMF), Christine Lagarde, has called on central banks around the world to consider issuing digital currencies.

— Citește pe www.ccn.com/imf-chief-lagarde-central-banks-should-consider-issuing-digital-currency/

BancorX Becomes the First dApp Across Blockchains – Coinjournal

BancorX, has added support for the EOS blockchain, becoming the first dApp to work across blockchains, it will allow the trading of ETH and EOS tokens.

— Citește pe coinjournal.net/bancorx-becomes-the-first-dapp-across-blockchains/

Reaping value from blockchain applications | Deloitte Insights

For most, the value of blockchain is still more potential than actual. But with barriers to adoption falling, the technology is edging closer to the mainstream.

— Citește pe www2.deloitte.com/insights/us/en/focus/signals-for-strategists/value-of-blockchain-applications-interoperability.html

Mainstream: ‘Big Four’ Auditor PwC Has 400 Crypto Specialists on Staff

Major auditing firms including PricewaterhouseCoopers (PwC) have hired hundreds of blockchain and crypto specialists to meet the industry’s growing needs.

— Citește pe www.ccn.com/mainstream-big-four-auditor-pwc-has-400-crypto-specialists-on-staff/